The trucking industry is the main reason why we can enjoy products from all over the world regardless of the time of the year. However, like any other industry, it has its issues and trends to look after in order to keep up the good work.

I have a friend who also happens to be a truck driver. In the beginning, he loved his job – always on the road, exploring new places, meeting new people, great salary, and great benefits. What else can you ask for, right? A few months ago, as we spoke, I noticed that his initial excitement and enthusiasm have almost vanished.

The spark from exploring new places was wearing off, the endless hours on the road were exhausting. And slowly the great salary and benefits could not compensate for the fact that he was always on the go, no time to stay in one place long enough to start a relationship and build a family.

My friend is just one of the many drivers who slowly realized that this job might not be what they’ve been looking for. It leads to some of the biggest issues in the trucking industry – hours of service and labor shortage.

Hours of Service

According to the 2014 American Transportation Research Institute (ATRI) report, the hours of service were the single most important and critical issue in the trucking industry. The issue first surfaced in 2007, which caused the U.S. Court of Appeals to set the 11-hour driving provision, followed by a 34-hour restart.

In 2013, the regulators introduced a new rule. It restricted the use of a 34-hour restart and required a 30-minute break after every 8 hours behind the wheel. As you would expect, a rule like this does not come without consequences for the industry. 80% of the carriers indicated a loss of productivity and driver pay impacts estimated to be between $1.6 and $3.9 billion annually. And that’s why just recently this rule was reset.

Shortage of Truck Drivers

Another concern for the trucking industry that has been on ATRI’s list since 2005 is the shortage of qualified drivers. According to the American Trucking Association (ATA), and ATRI – the freight volumes in the industry are continuously growing. However, the shortage of truck drivers could slow down the industry’s growth. Not having enough drivers prevents the companies from adding more trucks to their fleet, hence missing on freight and auto transportation offers simply because of lack of drivers.

The driver retention rate is just as scary as the drivers’ shortage. The turnover rate of truck drivers at large truckload fleets went up to 103% in the second quarter of 2014 and to 94% in the smaller truckload fleets, i.e. less than $30 million in revenue. These rates are at their highest since the third quarter of 2012. And if the industry continues to grow, it could only get worse. And according to some projections, the gap between the drivers’ supply and demand may reach 240, 000 by 2022, unless the trend changes direction.

Rules and Regulations

A number three concern and a growing trend for the Trucking Industry, according to ATRI is CSA, which stands for Compliance, Safety, Accountability. It is pretty straightforward.

CSA examines carriers’ and drivers’ compliance with the U.S. rules and regulations, as well as the safety of the motor carrier. Another issue on the list is the accountability of the trucking company for any issues that might arise on the road.

Safe Parking

Parking shortage is another issue that has been a big concern for the industry. More and more goods are produced in the United States. However, the US still imports large amounts of products. These products need to reach their final destination somehow. Consequently, it leads to high demand for trucks on the road, hence the need for more truck parking lots.

Ironically, the new Hours of Service Rule highlighted a dramatic shortage of safe and available parking for truckers. The rule requires drivers to take breaks and off-duty times at different locations. However, what do you do if the parking is full? Should the drivers keep on going, despite fatigue? It is a dangerous dilemma. And it has led many drivers to park in undesignated and potentially unsafe parking locations in order to comply with the new regulations.

Traffic Congestion

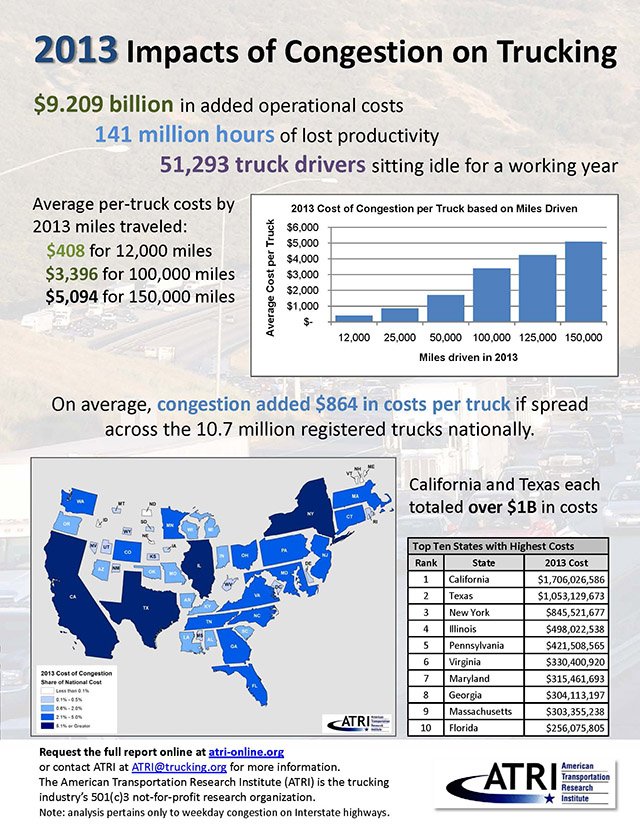

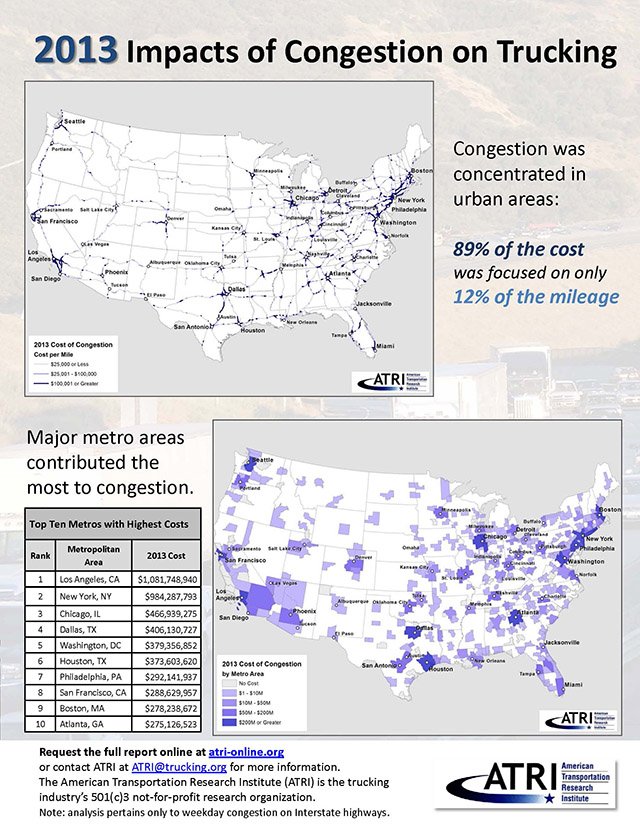

Not surprisingly, a growing trend for the trucking industry in general, and the auto transport industry in particular, is infrastructure and traffic congestion. To ensure on-time delivery trucks need to stick to a very tight schedule, which is heavily dependent on the state of the roads – highway maintenance and traffic jams. An estimated expense of $9.2 billion has been related to interstate congestion, according to ATRI, together with the crumbling infrastructure leads to the need for long-term transportation funding, which on its own creates an additional issue for the industry.

Health and Wellness

An important part of the industry is the health and wellness of its drivers, which is hard to maintain due to the hard conditions of the job itself. Obviously, there isn’t much you can do about the smog exposure when you are constantly on the road. However, when it comes to sleep deprivation, convenient food options, and off-duty times, there is definitely a lot more that can be done. It has been proven that improving the health and wellness of the drivers has a positive implication on the safety and driver retention rates.

Fuel Prices

It is impossible not to mention one of the main concerns of all drivers, not only in the trucking and auto transport industry but in general – fuel prices. Even though we’ve noticed a considerable decrease in the last couple of months of 2014, this does not necessarily mean that the transportation industry is able to save.

The increase in equipment costs, as well as labor costs in order to reduce the drivers’ turnover rate, has been balancing out with the reduction in oil prices. So in the long term, it doesn’t come as a savings option, much rather as a break-even point for the industry.

Below are some statistics from ATA that provide an overview of the trucking industry:

- The freight tonnage will grow by 23.5% from 2013 to 2025, i.e. from 69.1% in 2013 to 71.4% in 2025

- The truckload volume will grow by 3.5% a year through 2019 and then by 1.2% annually from 2020 to 2025. However, truckload carriers will make greater use of intermodal rail for intermediate and long-distance hauls

- Trucking is still the dominant mode of freight transportation in the United States with total revenue of 81.2% out of all freight revenue in 2014, up from 80.7% in 2012

- Trucks move the majority of all NAFTA trade – hauling 55.4% of all trade with Canada and 65.4% of all trade with Mexico

- Trucking employed more than 7 million people in 2013

- The average per truck costs caused by congestions in 2013, calculated in miles traveled, equal to $408 for 12 000 miles or $5 094 for 150 000 miles

- On average, the cost per truck due to traffic congestion is $864 spread across 10.7 million registered trucks

- The trucking industry is disproportionately dependent on truck drivers 45 years or older, many of which will retire within 10 to 20 years

- CSA’s regulations caused a 17% decline in violations since 2010, from about 600 000 violations per month to under 500 000

The data above only signifies the importance of the trucking industry to the U.S. economy. It also shows how codependent they actually are.

Have you been involved with the trucking industry in general or some of its subcategories like the auto transport industry? Let us know what you think about the issues and trends facing the trucking industry in the US and share your story. Thank you!